We welcome you to the bottom-of-the-barrel Industry. Where the 1% Percenter dread to go. Businesses where everyday people go for their day to day shopping and needs. Welcome to Cloud Toronto-FYBN Gas Station/Cstore Investment Opportunity. This is the the Final Sector of development at grassroot level. We are raising billion dollars to upgrade and upscale the gas station/cstores in USA.

In a world teeming with innovations, the retail industry finds itself in a perpetual dance of transformation, seeking solutions that resonate with the changing times and evolving needs. It’s a realm where antiquated systems jostle for space amidst groundbreaking evolutions, highlighting a pressing need for a revolution—an evolution that heralds accuracy, reliability, and an unparalleled understanding of the nuances of retail businesses, specifically gas station.

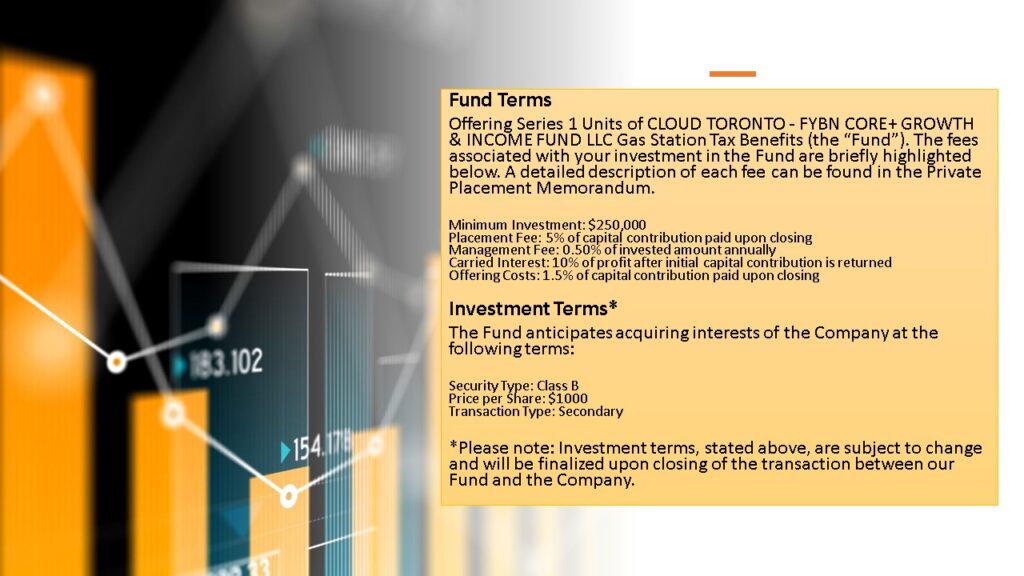

FYBN Tax Advantaged Opportunistic Gas Station Investment Fund:

FYBN – Augmenting untapped future of Clean Energy Gas Station Businesses.

What we do?

Unlocking Profit Potential: The World of Gas Station C-Store Business

In the realm of commerce and enterprise, few ventures are as multifaceted, dynamic, and lucrative as the gas station C-store business. At Cloud Toronto, we have honed our expertise to specialize in buying, building, operating, and ultimately exiting high cash flow gas station real estate and businesses. With a dedicated team of seasoned professionals who possess an intricate understanding of every facet of running a gas station C-store business, we are uniquely positioned to navigate the intricate world of fuel retailing.

The Gas Price Conundrum:

One of the key dynamics that sets the gas station business apart is the daily fluctuation of fuel prices. Gas prices are subject to continuous change, driven by a variety of factors, from geopolitical events to market dynamics. For the gas station dealer, these fluctuations represent both challenge and opportunity. While the end customers often feel the brunt of price variations, gas corporations do not always pass on the full extent of price benefits to the consumers. Instead, a significant portion of the profits generated from these price fluctuations is shared between the gas suppliers and the gas station dealer.

Multiple Revenue Streams:

What distinguishes the gas station C-store business from other retail endeavors is the presence of a diverse and robust revenue model. A typical gas station in a state like Georgia, for example, generates income from various sources, including:

Inside Sales: The products available inside the convenience store, including snacks, beverages, and other essentials, contribute significantly to overall revenue.

Gallon Sales: Gasoline sales make up a substantial portion of a gas station’s income, and the volume of sales can be influenced by factors like location and competitive pricing.

Lottery Sales: Many gas stations offer lottery ticket sales, providing an additional stream of income from hopeful customers seeking their lucky break.

ATM Commissions: By offering ATM services, gas stations earn commissions on each transaction, adding to the bottom line.

Money Transfer Services: Providing money transfer services is another source of revenue, as customers use the convenience of their local gas station to handle financial transactions.

Check Cashing Commissions: Some gas stations offer check-cashing services, earning commissions on each check processed.

Game Machine Commissions: Amusement and gaming machines within the store can be a source of additional income, depending on customer preferences.

Other Miscellaneous Businesses: Depending on the location and market, gas station C-stores may explore various other income streams, such as car washes, propane sales, or food service.

High Profit, High Risk, and Operational Intensity:

The gas station C-store business is undeniably a high-profit endeavor, but it is equally high risk. The profitability stems from the multiple revenue sources, but this landscape also poses inherent risks, making it a complex business to manage. It’s an operation-intensive business where the daily functioning is finely tuned and heavily dependent on employees who must handle a wide array of responsibilities, from managing inventory and assisting customers to ensuring compliance with industry regulations.

Conclusion:

The gas station C-store business is a unique and dynamic world, where understanding the nuances of gas pricing, optimizing multiple revenue streams, and effectively managing operational intricacies are keys to success. At Cloud Toronto, we embrace these challenges and opportunities, leveraging our expertise to make strategic investments and operate profit-generating gas station C-store businesses. In this ever-evolving industry, we are dedicated to delivering exceptional results and shaping the future of this dynamic enterprise.

How it works?

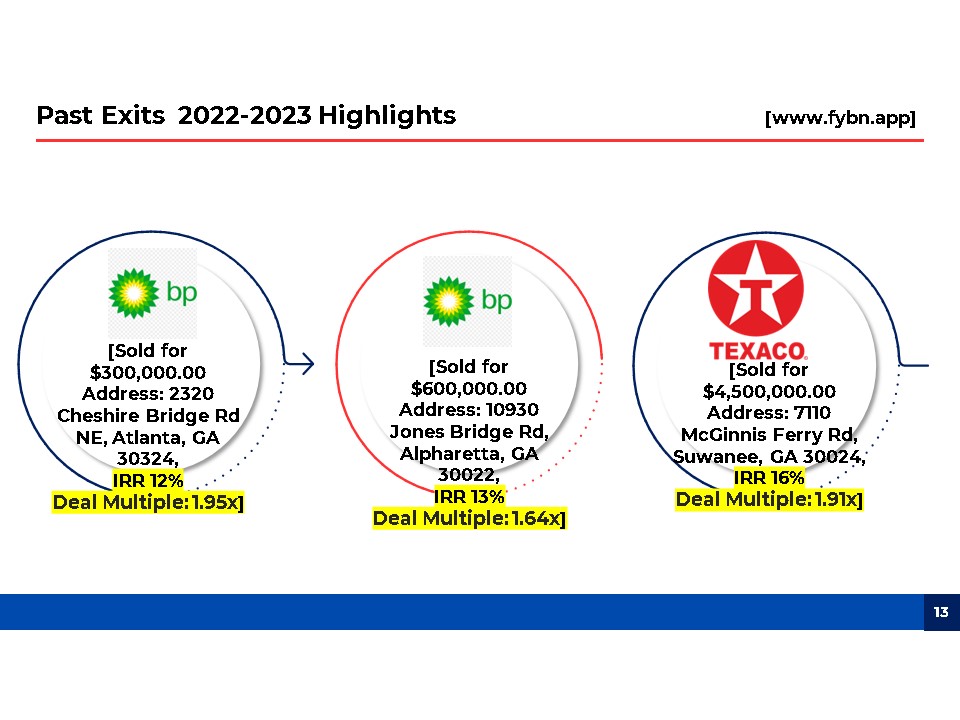

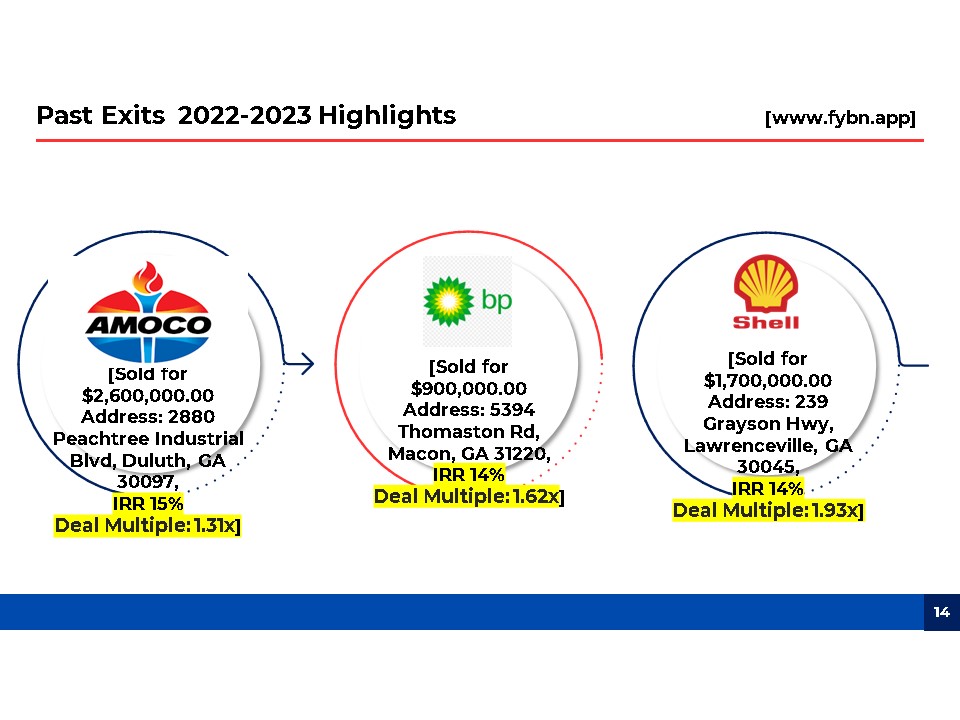

Exiting gas station investments at a minimum 50-60% margin is a pivotal aspect of our strategy at Cloud Toronto. We employ a combination of astute timing, market analysis, and comprehensive asset management to achieve such profitable exits. Our approach involves selling the gas station and related real estate when market conditions are favorable, leveraging the increased value created through operational enhancements. Additionally, we capitalize on the cyclical nature of gas prices, making strategic decisions to divest when gas prices peak. By maximizing the value of the gas station assets and choosing optimal exit points, we consistently secure substantial margins, reinforcing our reputation as adept investors in the gas station business.

CLOUD TORONTO - FYBN Clean Energy Gas Station Investment Fund.

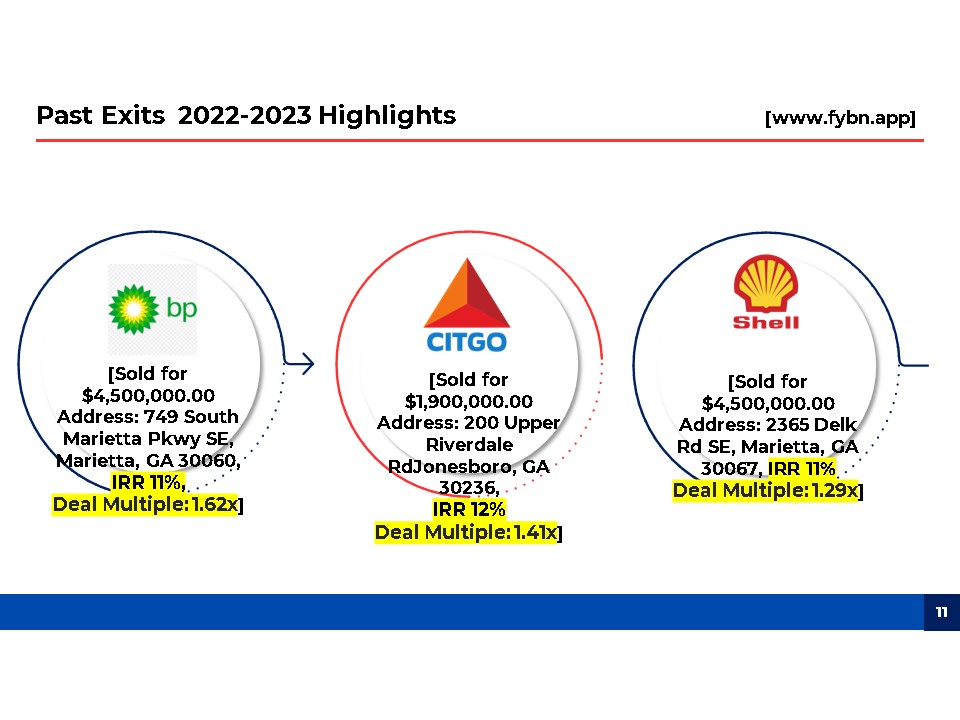

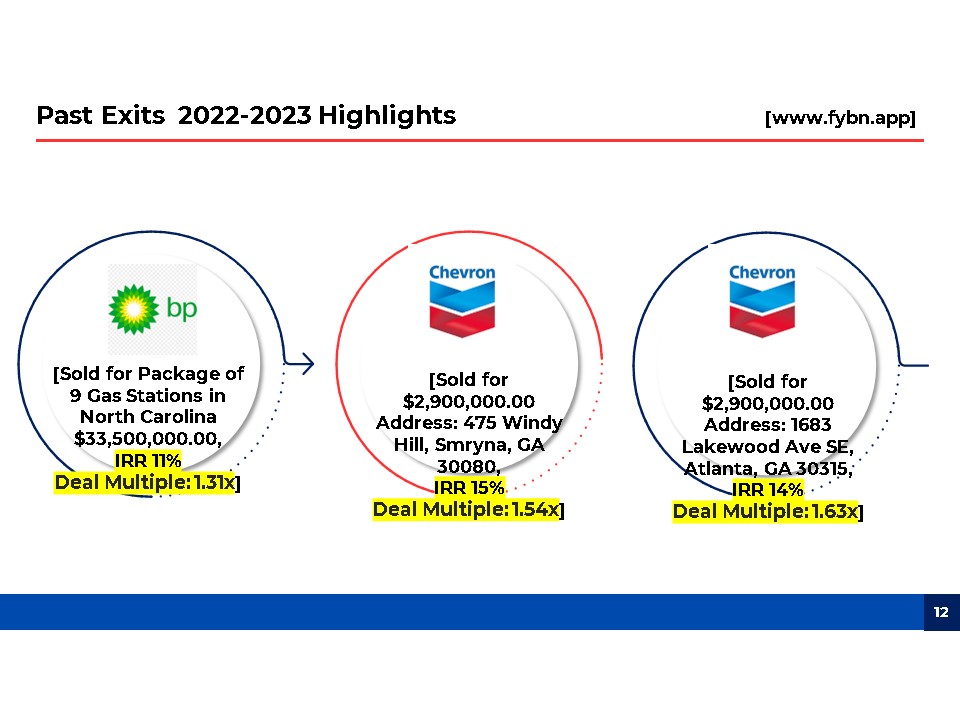

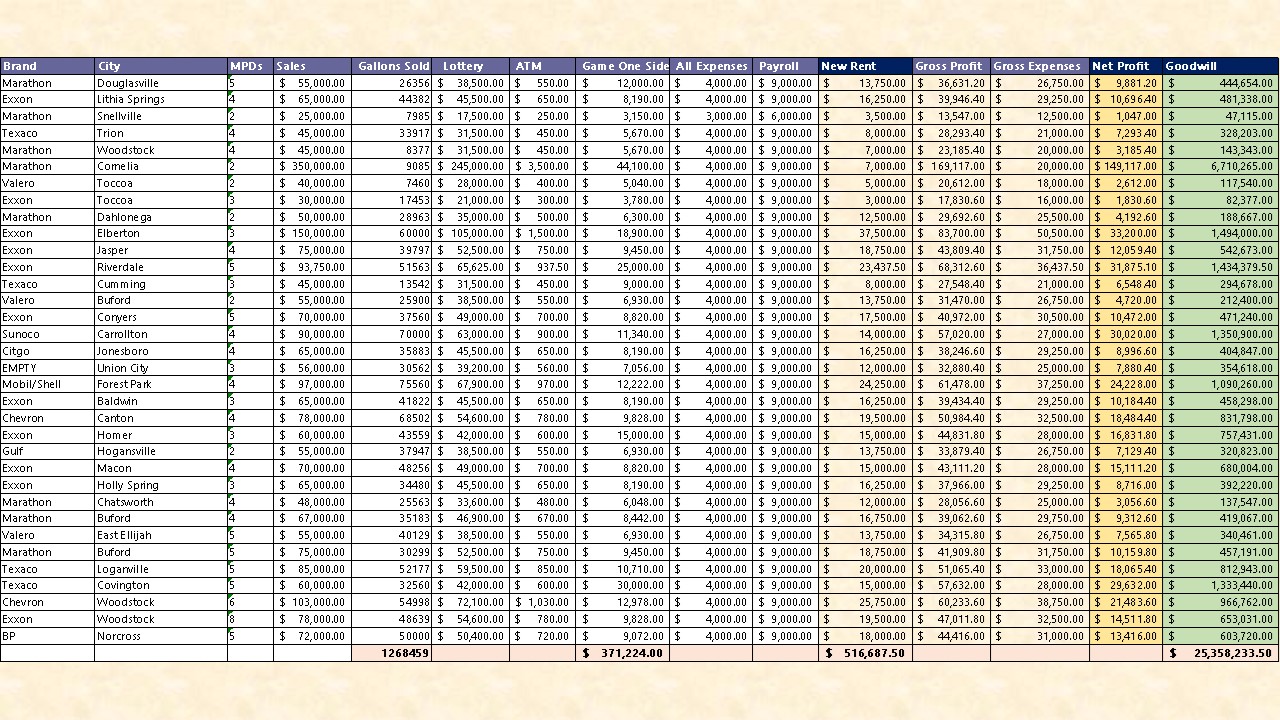

Past Exits and Performances

Local Business, International Brands.

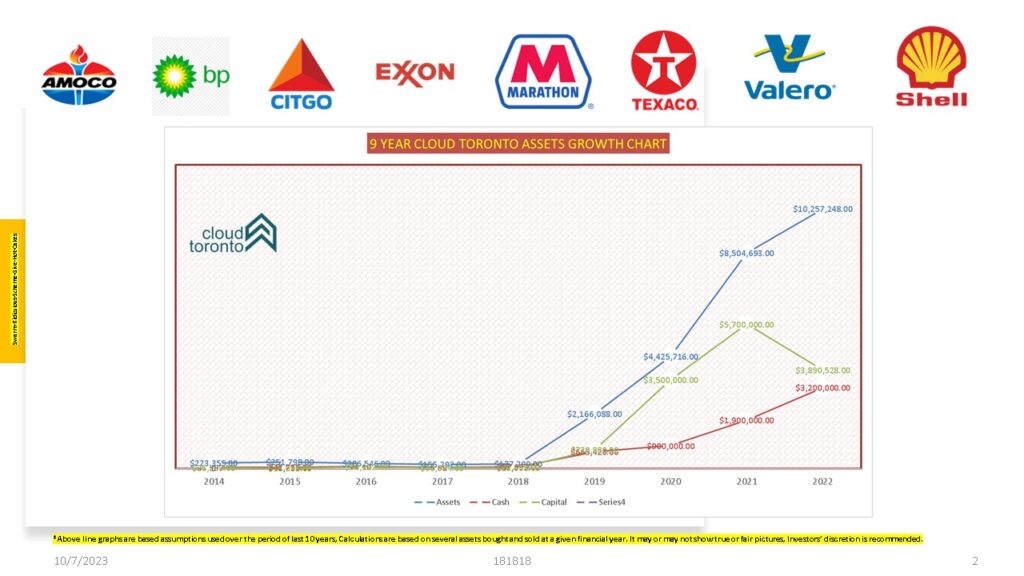

Financial 10 yr Snapshot

The Product -

FYBN Gas Station Investment Fund

In a world dominated by technological advancements, the FYBN App emerges as a beacon of innovation, a confluence of precision and reliability, poised to redefine the paradigms of retail business transactions. It’s not merely a product; it’s a revolutionary solution meticulously crafted to address the intricacies of business value estimations and transactions in the retail sector, with a concentrated focus on gas stations.

FYBN App, a breakthrough in the realm of retail business sale tools, employs cutting-edge Artificial Intelligence to yield almost accurate value estimations of businesses, intertwining a multitude of factors such as incomes, expenses, and various soft parameters. This meticulous amalgamation ensures unparalleled reliability and effectiveness, providing users with a seamless and trustworthy experience.

This transformative application delves deep into the subtleties of the retail sector, unravelling complexities and optimizing functionalities to facilitate ease in buying and selling. It embodies a spectrum of features meticulously designed to serve gas stations, ensuring every transaction is streamlined, every value estimation is precise, and every user experience is exemplary. The app stands as a testament to innovation, bridging gaps between business owners and potential buyers, fostering environments ripe for growth and success.

The essence of FYBN App lies in its relentless pursuit of excellence and precision. It’s a symphony of technological advancements and industry insights, harmonizing to create an environment where decisions are informed, transactions are transparent, and success is a tangible reality. The app resonates with the promise of simplifying complexities, offering a user-friendly interface coupled with a plethora of features aimed at demystifying the process of buying and selling gas stations.

Within the realms of FYBN App, users are empowered with tools that transcend conventional boundaries. The app offers a gateway to a world where transactions are not cumbersome processes but rather, opportunities for growth and exploration. It’s a world where reliability is not just a trait but a foundational pillar supporting every interaction, every decision, every step forward.

FYBN App’s relentless focus on gas stations delineates its commitment to addressing the specific needs and challenges of this sector. It’s an endeavor to bring forth solutions that are not generalized but rather, tailored to resonate with the distinct dynamics of gas station businesses. This concentrated approach amplifies the app’s impact, making it a quintessential partner for every gas station owner aspiring to carve their success stories in the evolving landscapes of the retail sector.

The inception of FYBN App marks the beginning of a new era, an era where accuracy meets reliability, where innovation converges with simplicity, and where every gas station business owner is equipped with the tools to navigate their journey with confidence and clarity. It’s a transformative journey, a journey marked by unparalleled insights, unyielding dedication, and an unwavering vision to redefine the norms and elevate the standards of the retail business sector.

FYBN App is not just changing the game; it’s rewriting the rulebook. It’s a journey into the future, a future where the realms of possibility are boundless, and the horizons of success are limitless.

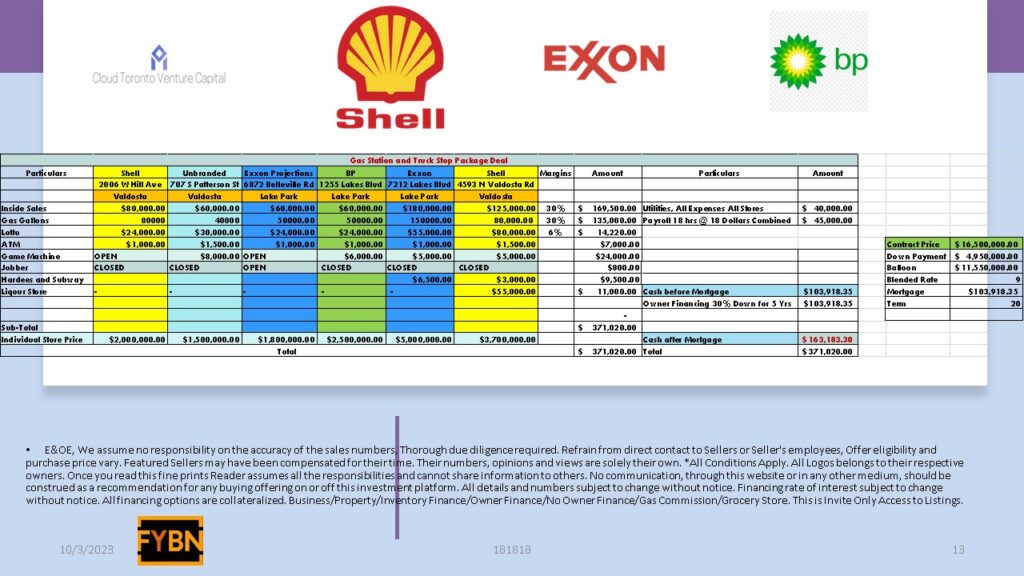

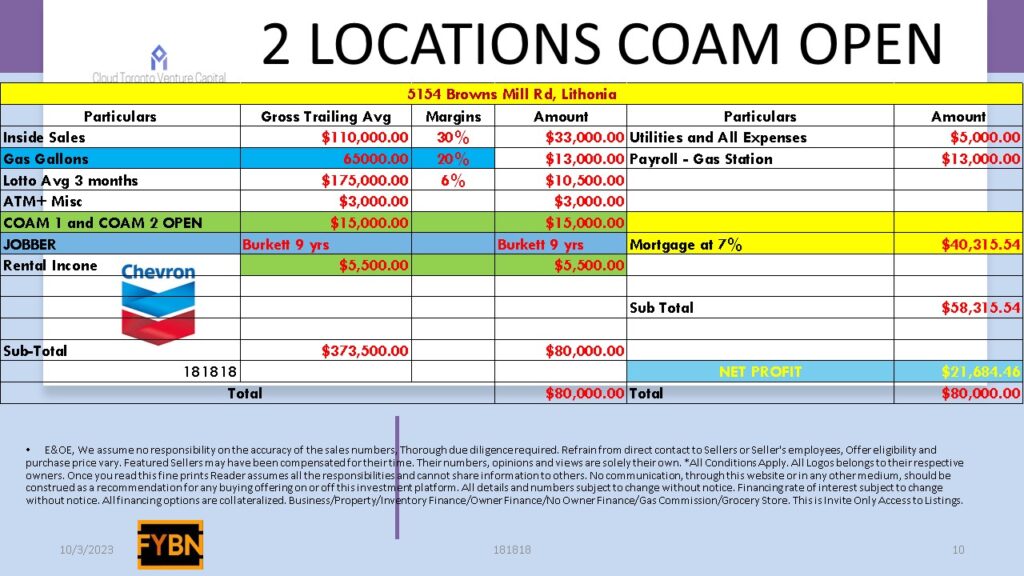

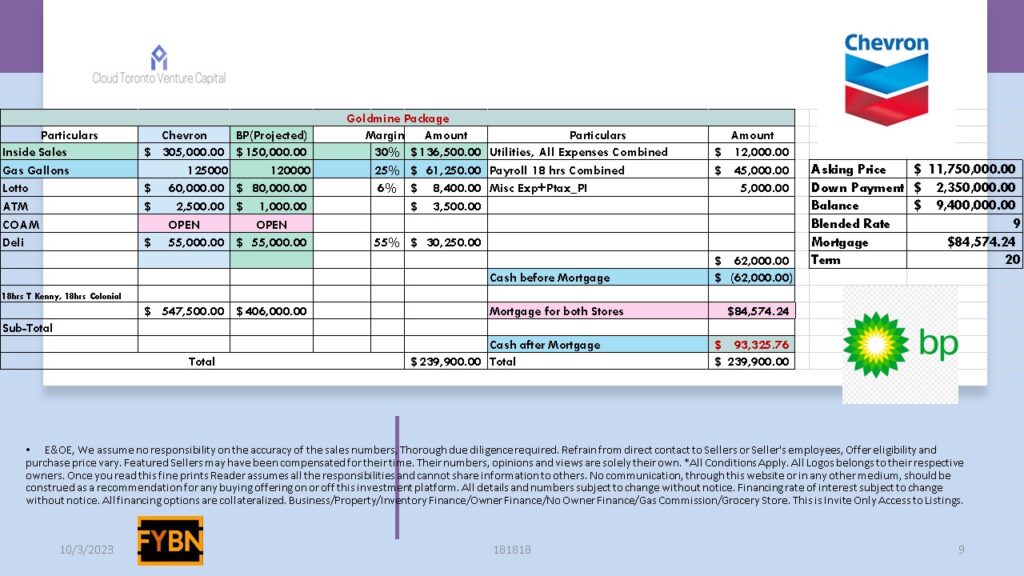

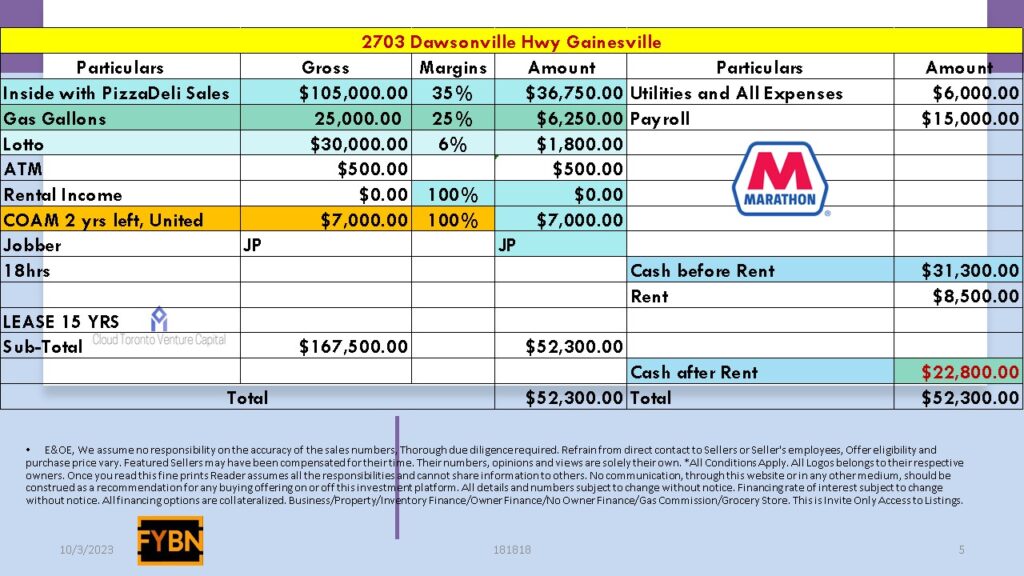

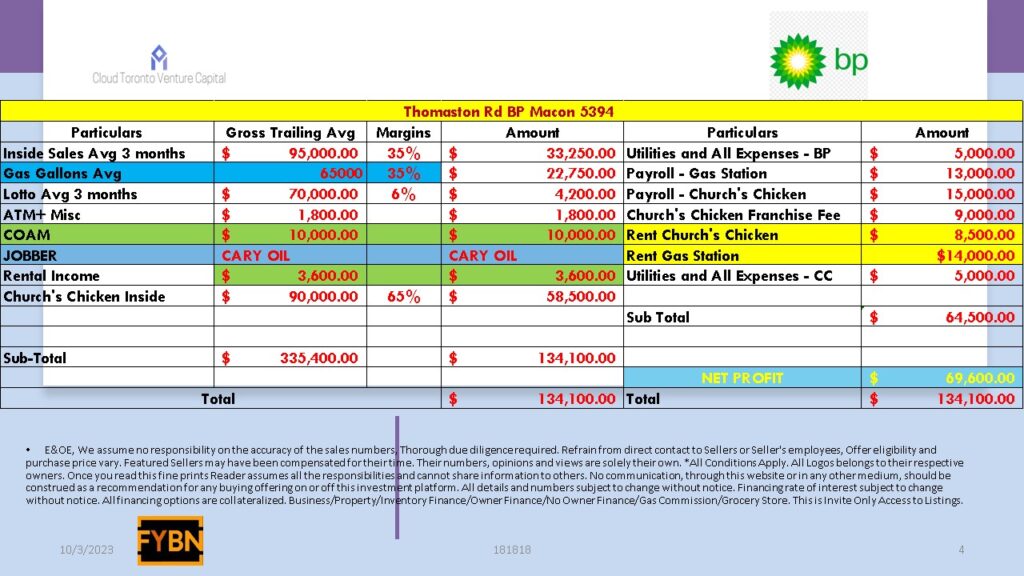

Current Potential Fund Assets

Origin Story

The Inception of FYBN FYBN Gas Station Investment Fund

The FYBN App emerged from Dilip Mooparakath’s vision to address the complexities and inefficiencies in the C Store business sector. Dilip’s research unraveled the top 15 reasons businesses sell, forming the basis for a solution to streamline business valuation and transactions.

A Catalyst for Investors:

FYBN Gas Station Investment Fund underscores the potential of high cash flow gas stations and convenience stores as steady income sources for investors. Their essential products offer a stable income stream in the unpredictable realm of business investments.

Diversification and Appreciation:

The app promotes investment diversification, spotlighting the appreciative value of gas station real estate. It’s not just about facilitating transactions but about unveiling the sector’s latent potential and value.

Innovations and Opportunities:

FYBN’s innovation lies in bridging investors from varied sectors to introduce new operational efficiencies in gas stations and convenience stores. It further opens doors to franchise opportunities, providing turnkey business models with comprehensive support.

Addressing Risks and Offering Solutions:

FYBN Gas Station Investment Fund doesn’t just highlight rewards; it emphasizes the risks of gas station ownership. The platform advocates for comprehensive due diligence, market trend analysis, and expert consultations to ensure well-informed investments.

Conclusion:

The journey of FYBN Gas Station Investment Fund is more than its creation story. It melds innovation, insights, investor advantages, and enduring solutions, presenting a comprehensive answer to the challenges of the gas station and convenience store business sector.

Invest in our current Gas Station Investment Pipelines.

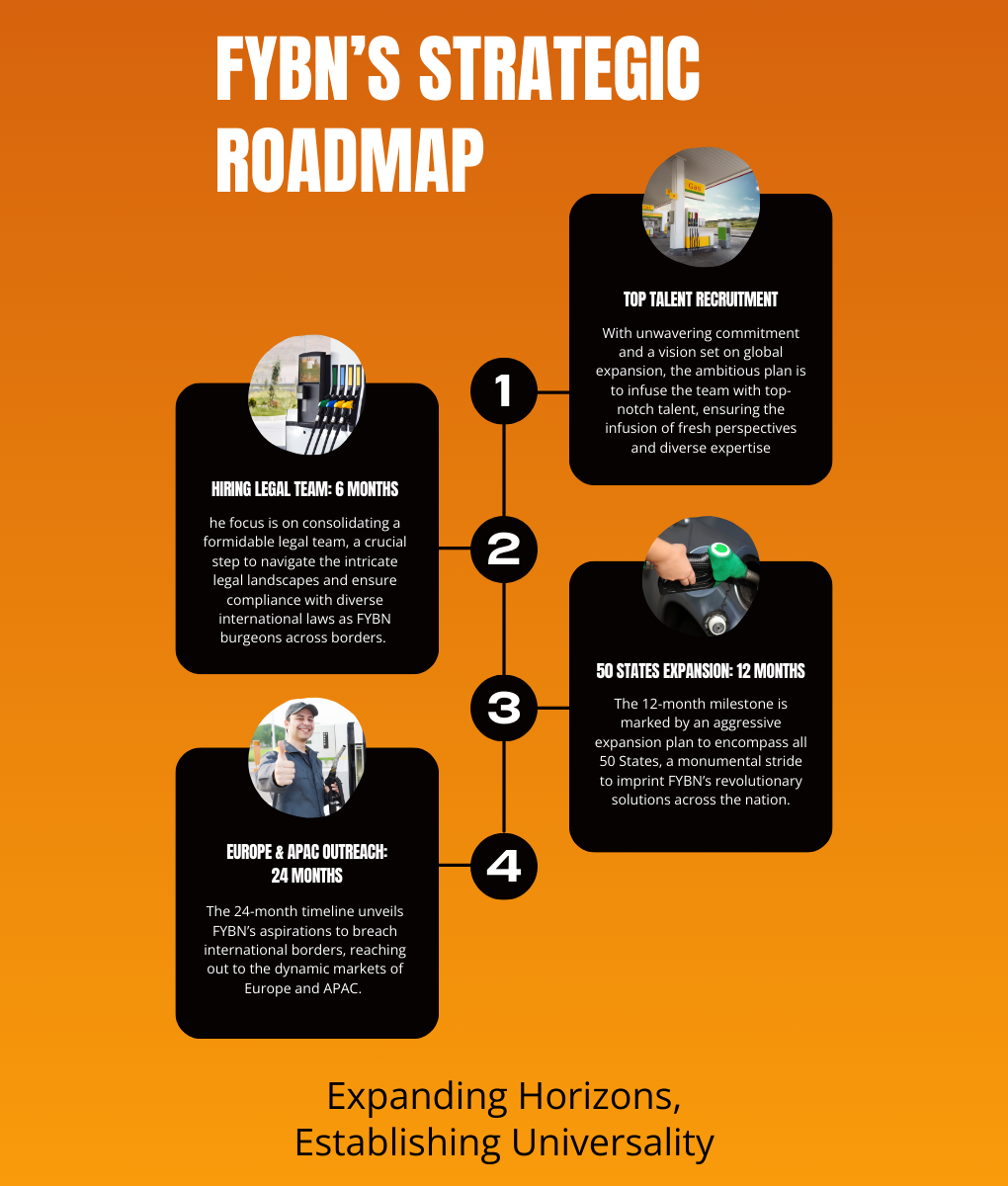

Project Plan & Schedule

Gas Station Investment Fund

Embarking on a journey of relentless innovation and global reach, FYBN Gas Station Investment Fund is fervently charting a strategic roadmap, meticulously planned to set unprecedented benchmarks in the industry. With unwavering commitment and a vision set on global expansion, the ambitious plan is to infuse the team with top-notch talent, ensuring the infusion of fresh perspectives and diverse expertise, aimed at shaping FYBN as a holistic, universal solution in the realm of retail business sales.

Within the next six months, the focus is on consolidating a formidable legal team, a crucial step to navigate the intricate legal landscapes and ensure compliance with diverse international laws as FYBN burgeons across borders. This phase is pivotal for laying a robust foundation, fortifying FYBN’s capabilities to face the multifarious challenges of international expansion.

The 12-month milestone is marked by an aggressive expansion plan to encompass all 50 States, a monumental stride to imprint FYBN’s revolutionary solutions across the nation. This expansion is not just geographical; it’s about permeating diverse markets, understanding varied retail landscapes, and customizing solutions to resonate with the distinct needs of each state.

The 24-month timeline unveils FYBN’s aspirations to breach international borders, reaching out to the dynamic markets of Europe and APAC. This is the phase of transcending boundaries, of embracing the diversity of retail landscapes, and of evolving to meet the unique demands and challenges posed by varied economic ecosystems.

Every step in FYBN’s strategic roadmap is a leap towards establishing it as a universal solution, resonating with global needs, and rewriting the paradigms of retail business transactions.

Budget & Funding

We are looking for an investment of $100,000,000 over the next 6 months to market FYBN and enhance the app’s reach and downloads. The funds will be allocated meticulously to ensure optimal utilization in marketing, team expansion, and geographical enlargement.

Use of Proceeds

Strategic Use of Proceeds

At Cloud Toronto – FYBN, we believe in prudent financial management and strategic reinvestment of funds. Here’s a breakdown of how we intend to allocate the proceeds:

1. Reinvestment in High Cash Flow Real Estate (90%): A significant portion of the funds, approximately 90%, will be strategically reinvested in acquiring high cash flow commercial real estate assets. Our focus areas include gas stations, C-stores, liquor stores, extended-stay hotels, and premium high-traffic, high Average Daily Rate (ADR) hotels and related businesses. These investments have proven to be reliable sources of consistent income, and we aim to expand and diversify our portfolio for long-term profitability.

2. Talent Acquisition (5%): To ensure our operations run seamlessly and efficiently, 5% of the proceeds will be dedicated to hiring the best talents across various departments. The success of our real estate investments hinges on the expertise and dedication of our team. We are committed to recruiting top professionals who can contribute to our growth and success.

3. Marketing and Expansion (5%): In an ever-evolving market, effective marketing is paramount. We will allocate 5% of the funds to market our various commercial real estate assets, attracting more traffic and businesses. Our marketing efforts will not be limited to the USA; we have ambitious plans to expand our footprint to Canada, the UK, Australia, South America, and Asian countries in the next five years. This expansion represents an exciting opportunity for growth and diversification, and our marketing efforts will play a pivotal role in driving it forward.

Conclusion:

Cloud Toronto – FYBN is dedicated to prudent and strategic financial management. We aim to leverage the proceeds from our investments to expand and diversify our portfolio, recruit top-tier talent, and effectively market our assets in both our current and prospective international markets. This approach aligns with our vision of becoming a global player in the commercial real estate industry, with a strong commitment to long-term success and profitability.

Passion & Commitment

Our Team’s unwavering passion and the team’s relentless commitment are the driving forces behind FYBN’s mission to democratize the buying and selling of Cstore businesses, ensuring that every business owner has a profitable exit route and opportunities to venture into bigger and better Cstore businesses.

Investing In FYBN Gas Station Investment Fund

Investing in FYBN Gas Station Investment Funds, which have over 400 gas stations in Georgia and a software platform that covers over 1000 cities in the state, presents an intriguing opportunity in the gas station business. Here are some key points to consider:

- Diversification: With over 400 gas stations in Georgia, your investment is well-diversified across locations and markets, reducing the impact of any single market’s fluctuations on your overall portfolio.

- Market Coverage: The software platform covering over 1000 cities in Georgia can provide valuable data and insights to optimize the gas station operations, such as pricing strategies, inventory management, and marketing efforts.

- Profitability: The gas station business typically operates on thin profit margins, but a 40 – 45% profit range suggests efficient operations and potentially competitive advantages in terms of pricing, product offerings, or services.

- Cash Flow: The heavy cash flow nature of the business can be advantageous for investors, providing a consistent stream of income that can be reinvested or distributed as returns.

- Operational Intensity: It’s important to recognize that gas stations are highly operational- intensive businesses. Proper management, maintenance, compliance with regulations, and customer service are critical for success.

- Economies of Scale: Having a significant number of gas stations in the portfolio may allow for economies of scale in procurement, marketing, and management, potentially increasing profitability.

- Market Stability: Georgia’s gas station market may be relatively stable due to consistent demand for fuel and essential goods, making it less susceptible to economic downturns.

- Exit Strategy: Consider your exit strategy. A well-managed portfolio of gas stations can be attractive to potential buyers or investors looking for stable income streams.

- Risk Management: Despite the potential rewards, it’s important to assess and manage risks associated with gas station investments, including environmental compliance, competition, fuel price fluctuations, and regulatory changes.

- Due Diligence: Before investing, conduct thorough due diligence on the specific gas stations in the portfolio. Evaluate their locations, market conditions, financial performance, and any potential value-add opportunities.

- Tax Considerations: Work closely with tax professionals to understand the tax implications of your investment, including depreciation, deductions, and any tax credits available in Georgia.

- Professional Management: Consider whether the investment funds have experienced and professional management in place to oversee the operations, maintenance, and strategic direction of the gas station portfolio.

- Long-Term Strategy: Determine whether your investment aligns with a long-term strategy, as the gas station business can provide stable income over an extended period.

Before making any investment, consult with financial advisors and conduct a comprehensive analysis to ensure that it aligns with your investment goals, risk tolerance, and financial strategy. Additionally, seek legal and financial advice to fully understand the terms and conditions of your investment in FYBN Gas Station Investment Funds.

FYBN Gas Station Investment Fund Core Team

Embarking on a journey to revolutionize the retail business realm is an assemblage of minds marked by unwavering resolve, diverse experiences, and a unified vision to redefine industry paradigms. At the epicenter of this transformative endeavor stands Dilip Mooparakath, the pioneering spirit and the visionary fueling the drive behind FYBN App.

Dilip, a luminary in the domain, armed with an MBA and two decades of multifaceted experience, serves as the Founder and President of FYBN. With a moniker, “Everything” Entrepreneur and Growth Capitalist, he orchestrates the symphony of change with profound acumen in technology and business. His experience spanning various pivotal roles has been the cornerstone, laying the foundations for FYBN’s unprecedented trajectory. The amalgamation of his extensive knowledge in Business and Commercial Real Estate has intricately woven the fabric of innovation and precision that defines FYBN App.

Collaborating closely with Dilip are stalwarts like Krrish Mooparakath, the Partner-Head of Monetization, harboring a distinctive flair for strategizing international business growth. With his insights, FYBN aims to expand its horizons, navigating the uncharted territories of international markets. Zuhed Khan, the maestro of technology, spearheads the technological facets of FYBN App. His 13 years of profound experience and certified proficiency have been instrumental in crafting a state-of-the-art app, resonating with reliability and excellence.

The collaborative symphony doesn’t just resonate within the borders of the USA; it extends, intertwining with off-site tech and sales maestros stationed in Canada and India. Every member, a virtuoso in their domain, contributes to painting the broader picture, aligning their passions and skills to bring forth a masterpiece that is set to reshape the landscapes of retail business sales. Our team, a conglomerate of seasoned professionals, excels in negotiating and structuring transactions, bringing to the table unique industry knowledge and access to extensive financial resources. The ensemble’s cumulative experience and expertise have facilitated close to a billion dollars in various transactions since FYBN’s inception in 2012, assisting clients in navigating through acquisitions, divestitures, refinancing opportunities, and advanced capital structures.

The team’s commitment extends beyond mere transactional engagements; it’s a commitment to reimagining potentials, optimizing opportunities, and crafting a future that resonates with growth, excellence, and unprecedented success. It’s a convergence of visionaries, tech gurus, and strategists, each a beacon illuminating the path to a revolutionary transformation in the retail business sector.

With a shared dream and unparalleled dedication, this brigade of changemakers is not just building a product; they are crafting the future of retail business sales. They are the architects of a new dawn, where every gas station business owner can redefine their success stories, embrace their destinies, and soar to new heights in the evolving realms of retail businesses.

Rewards & Perks

Investors embarking on this transformative journey with FYBN will play a pivotal role in reshaping the retail business landscape, becoming catalysts for revolutionary change in the global retail sector. It’s not merely about experiencing financial gains but about actively contributing to industry innovation and witnessing the transformative impact of FYBN firsthand. With a promising 10% IRR, investors will not only reap substantial financial rewards but also experience the gratification of being integral to pioneering change in the industry.

Investment Rationale with Cost Segregation Strategy

Investing in a gas station property and applying cost segregation with an Internal Rate of Return (IRR) target of 10% can provide a compelling rationale. Here’s an investment rationale that outlines the benefits:

FYBN Investment Rationale for Gas Station Property/Business Investment with Cost Segregation (IRR 10%)

- Enhanced Cash Flow: Cost segregation allows for the acceleration of depreciation deductions on eligible assets within the gas station property. This leads to higher depreciation expenses, which, in turn, reduces taxable income. As a result, you’ll have increased cash flow due to lower tax liabilities.

- Faster ROI (Return on Investment): By leveraging cost segregation, you can front-load depreciation benefits, leading to a quicker return on your initial investment. The IRR of 10% reflects this faster return and demonstrates the potential for solid cash returns.

- Tax Efficiency: Cost segregation is a tax-efficient strategy that can significantly reduce the property’s taxable income. The savings generated from reduced taxes can be reinvested into the property or used for other investment opportunities.

- Asset Appreciation Potential: Gas station properties located in high-demand areas with growing populations and businesses often appreciate in value over time. This appreciation potential can contribute to the overall return on investment.

- Diversification: Gas station properties provide diversification within your investment portfolio, as they are typically not closely correlated with other asset classes, such as stocks or bonds. Diversification can help mitigate overall portfolio risk.

- Stable and Recurring Income: Gas stations tend to generate stable and recurring income, primarily from fuel sales and convenience store operations. This can provide a consistent cash flow stream to support your investment objectives.

- Value-Add Opportunities: Beyond cost segregation, you may identify value-add opportunities within the gas station property. These could include expanding the convenience store, adding additional services (e.g., car wash), or improving operational efficiency to increase revenue.

- Demand Resilience: Gasoline is a staple product with consistent demand, making gas stations relatively resilient to economic downturns. This stability can contribute to a steady income stream and protect against market volatility.

- Long-Term Investment Potential: A gas station property investment, when well-maintained and strategically managed, can be a long-term asset. Over time, it may appreciate in value and continue to generate income, contributing to a sustainable IRR.

- Risk Mitigation: By applying cost segregation and optimizing the property’s operations, you can mitigate certain risks associated with gas station investments, such as regulatory compliance and environmental liabilities.

- Exit Strategy Options: Gas station properties offer various exit strategy options. You can sell the property at a higher valuation, exchange it for another investment property, or pass it on to heirs as part of your estate planning.

- Professional Management: Engaging professional property management or partnering with experienced operators can help ensure the efficient and effective operation of the gas station, further enhancing the investment’s IRR potential.

It’s important to conduct a thorough feasibility study, due diligence, and financial analysis specific to your gas station property investment to validate the projected IRR of 10%. Additionally, work closely with tax professionals to implement cost segregation effectively, comply with tax laws, and maximize the tax benefits associated with your investment.

Environmental Commitment

FYBN is resolutely committed to fostering environmental sustainability, recognizing the essential nature of ecological responsibility in today’s rapidly evolving world. Understanding the potential environmental implications associated with gas stations, FYBN strives to implement eco-friendly practices and supports innovations aimed at mitigating environmental impacts. The app encourages the integration of sustainable solutions such as alternative fuels and energy-efficient systems in gas stations, thereby promoting environmental conservation. Additionally, FYBN endorses adherence to stringent environmental compliance, safety, and health standards, aiming to reduce the ecological footprint of the retail business sector. This commitment reflects FYBN’s dedicated approach to amalgamating technological advancement with ecological preservation, contributing to a more sustainable and environmentally conscious future.

Risks and Challenges

Investing in gas station businesses presents a complex landscape of risks and challenges, necessitating meticulous consideration and analysis by potential investors. Economic conditions and fuel price volatility play a pivotal role, influencing revenues and affecting profit margins. The industry’s competitive nature and market saturation may limit growth opportunities and pressure pricing and margins. Regulatory compliance and environmental risks associated with Underground Storage Tanks (USTs) necessitate strict adherence to standards to avoid legal liabilities and fines. Evolving consumer trends and technology disruption are reshaping demand, requiring adaptability and strategic foresight. Security concerns, supplier relationships, operational challenges, and market volatility further complicate the investment landscape. It’s imperative for investors to undertake comprehensive due diligence, consider prevailing market conditions, consult industry experts, and seek legal and financial counsel to navigate these challenges effectively and make informed, astute investment decisions. The intricate interplay of these factors underscores the importance of a discerning approach to investing in gas station businesses, balancing potential rewards with inherent risks.

Call to Action

Join us in making history! Be part of the revolutionary change FYBN Gas Station Investment Fund is bringing to the retail industry. Invest in FYBN Gas Station Investment Fund and contribute to creating a seamless, efficient, and prosperous future for gas station businesses globally.

FAQs

What is a gas station investment?

A gas station investment involves purchasing or operating a gas station with the expectation of generating a return on your investment.

What are the key factors to consider before investing in a gas station?

Key factors include location, competition, financial stability, and regulatory requirements.

Is it profitable to invest in a gas station?

Profitability depends on factors like location, management, and market conditions. It can be profitable but isn’t guaranteed.

What are the different types of gas station investments?

You can invest in existing gas stations, buy a franchise, or build a new station from the ground up.

How important is the location of a gas station?

Location is critical. High traffic areas with limited competition are generally more profitable.

What licenses and permits are required to operate a gas station?

The specific requirements vary by location, but typically include business licenses, environmental permits, and safety certifications.

What are the typical operating costs for a gas station?

Operating costs include fuel purchases, employee salaries, maintenance, utilities, and insurance.

How can I finance the purchase of a gas station?

You can finance a gas station through personal savings, loans, or by partnering with investors.

What are the risks associated with gas station investments?

Risks include fluctuating fuel prices, environmental liabilities, and changes in consumer behavior.

How do I determine the value of a gas station?

The value is often based on factors like cash flow, location, property value, and potential for growth.

Are there any environmental concerns associated with gas station investments?

Yes, potential environmental contamination from fuel leaks is a concern. Proper maintenance and compliance with regulations are essential.

Can I convert a gas station into another type of business?

Converting a gas station into another business may be possible, but it depends on local zoning regulations and structural considerations.

What is the typical return on investment (ROI) for a gas station?

ROI varies widely, but a well-run gas station can provide a reasonable return on investment over time.

What are the advantages of owning a franchise gas station?

Franchise gas stations offer brand recognition, marketing support, and established operational processes.

How can I attract customers to my gas station?

Offering competitive fuel prices, convenience store items, and loyalty programs can help attract and retain customers.

Is it a good idea to buy a gas station with a convenience store?

Combining a gas station with a convenience store can enhance profitability as it offers additional revenue streams.

Are there tax benefits to owning a gas station?

Tax benefits may include deductions for operating expenses, depreciation, and potential credits for environmental cleanup costs.

What is the typical lease structure for gas station operators?

Lease structures vary, but they can include fixed rent, percentage-based rent, or a combination of both.

How can I mitigate the risk of fuel price fluctuations?

Diversifying revenue streams, optimizing inventory management, and monitoring fuel price trends can help mitigate this risk.

Is it possible to sell my gas station investment in the future?

Yes, you can sell your gas station investment. The ease of sale and potential profit depend on market conditions and the condition of your business.

A “Core Plus” investment strategy typically involves properties that are considered to be a step above core properties but still require some level of active management to achieve their full potential. While whether a gas station property qualifies as “Core Plus” depends on various factors, here are some considerations:

- Location: A gas station’s location is critical. If it is in a prime, high-traffic area with strong demographics and limited competition, it may qualify as Core Plus.

- Property Condition: The condition of the gas station property matters. If it is well-maintained and up-to-date, it may be more likely to be classified as Core Plus.

- Income Stability: Gas stations with consistent and predictable income, such as long-term tenant leases, may be more appealing as Core Plus investments.

- Potential for Value-Add: Properties with untapped potential, such as the ability to expand the convenience store, add additional services, or optimize operations, can qualify as Core Plus if they offer opportunities for value enhancement.

- Market Trends: Consider the current and future market trends for gas stations in the area. Is there a growing demand for fuel and convenience store services?

- Regulatory Compliance: Ensure that the gas station complies with all environmental, safety, and zoning regulations. Properties that have already addressed potential regulatory issues may be more attractive.

- Lease Terms: If there are long-term lease agreements in place with reputable tenants, it can enhance the property’s Core Plus status.

- Financial Performance: Evaluate the historical financial performance of the gas station. A property with a track record of generating consistent income may be viewed more favorably.

- Competitive Analysis: Assess the competitive landscape. If the gas station has a competitive advantage, such as offering unique services or having strong brand recognition, it may qualify as Core Plus.

- Exit Strategy: Consider your exit strategy. A Core Plus property should have the potential for capital appreciation over time, allowing you to sell it at a higher value.

It’s important to note that the classification of a property as Core, Core Plus, or any other category can vary depending on individual investment criteria and market conditions. Investors and real estate professionals typically use these categories as a general guideline, but the specific classification of a property should be based on a comprehensive analysis of its unique attributes and potential.

Before classifying a gas station property as Core Plus, it’s advisable to consult with real estate experts and conduct thorough due diligence to determine if the property aligns with your investment goals and risk tolerance.

The Company, FYBN Gas Station Investment Fund Systems, is a gas station / cstore developer focused on artificial intelligence, machine learning, and deep learning processing for research, government, and corporate organizations.

The Company is subject to a number of significant risks that could result in a reduction in its value and the value of the Company Securities, potentially including, but not limited to:

- Inability of the Company to complete an initial public offering of its securities, merger, buyout or other liquidity event,

- Inability to expand and maintain market acceptance for the Company’s services and products in the United States,

- Inability to gain access to international markets and comply with all applicable local laws and regulations,

- Rapidly changing consumer preferences and market trends,

- Inability to achieve management’s projections for growth, to maintain or increase historical rates of growth, or to achieve growth based on past or current trends,

- Inability to develop, maintain and expand successful marketing relationships, affiliations, joint ventures and partnerships that may be needed to continue and accelerate the Company’s growth and market penetration,

- Difficulties in managing rapid growth effectively,

- Inability to keep pace with rapid industry, technological and market changes that could affect the Company’s services, products and business,

- Potential costs and business disruption that may result if the Company’s customers complain or assert claims regarding the Company’s technology,

- Failure to adequately address data security and privacy concerns in compliance with U.S. and international laws, rules and policies,

- Technological problems, including potentially widespread outages and disruptions in Internet and mobile commerce,

- Performance issues arising from infrastructure changes, human or software errors, website or third-party hosting disruptions, network disruptions or capacity constraints due to a number of potential causes including technical failures, cyber attacks, security vulnerabilities, natural disasters or fraud,

- Inability to adequately secure and protect intellectual property rights,

- Potential claims and litigation against the Company for infringement of intellectual property rights and other alleged violations of law,

- Difficulties in complying with applicable laws and regulations, and potential costs and business disruption if the Company becomes subject to claims and litigation for legal non-compliance,

- Changes in laws and regulations materially affecting the Company’s business,

- Liability risks and labor costs and requirements that may jeopardize the Company’s business,

- Ongoing need for substantial additional capital to support operations, to finance expansion and/or to maintain competitive position,

- Issuance of additional Company equity securities at prices dilutive to existing equity holders,

- Dependence on and inability to hire or retain key members of management and a qualified workforce,

- Potential significant and unexpected declines in the value of Company equity securities, including prior to, during, and after an initial public offering, and

- Other risks that are not generally disclosed or known, in part because the Company is privately held and does not provide risk disclosure in publicly available reports.

In addition, the gas station / cstore industry is highly competitive, and the Company may not be able to compete effectively against the other businesses in its industry. The Company faces competition from a large number of competitors, including EXXON MOBIL, CHEVRON, BP, SHELL and Other Private Operators and Owners Like Quik Trip, WAWA, etc, some of which have longer operating histories, significantly greater financial, technical, marketing, distribution and other resources and greater name recognition than the Company does. These and other companies may develop new services and products and marketing and distribution channels in advance of the Company or establish business models or technologies disruptive to the Company’s business. Moreover, current and future competitors of the Company may also make strategic acquisitions or establish cooperative relationships among themselves or with others. By doing so, they may increase their ability to meet the needs of customers and potential customers. To the extent that the Company is not able to compete successfully against current and future competitors, the Company’s business, results of operations and financial condition may suffer. It is impossible for anyone to know with any certainty which of the companies will be more successful than the others, and an investment will be subject to all of the risks inherent in any investment in a nascent business and industry with a number of different competitors.

The business of the Company and investment in the Company Securities may also be jeopardized by stagnant economic conditions and by political, geopolitical, regulatory, financial and other developments in the United States, Europe, China, the Middle East and elsewhere around the world, including incidents of war and terrorism, outbreaks and pandemics of serious communicable diseases such as COVID-19 and Ebola, and natural and man- made disasters that are beyond the Company’s control and could disrupt its business and adversely affect its performance and financial condition.

Investors must understand that by purchasing Units they are voluntarily assuming all of the risks of the investment, including any and all risks relating to the Company and Company Securities, whether disclosed in this Fund Summary, Offering Memorandum and Supplement or not.

Information provided by Cloud Toronto Inc. about the company discussed in this summary (the “Company”) is not intended to be, nor should it be construed or used as, investment, tax or legal advice, a recommendation, or an offer to sell, or a solicitation of an offer to buy, an interest, directly or indirectly, in the Company. Any offer or solicitation of an investment in the Company may be made only by delivery to qualified investors of the confidential private offering memorandum and documents attached as exhibits to the offering memorandum. You should rely solely on those offering documents in making any investment decision. An investment in the Company is not suitable for all investors.